Un-Crumbling Infrastructure

How to Combat the Tax Hike Scaries

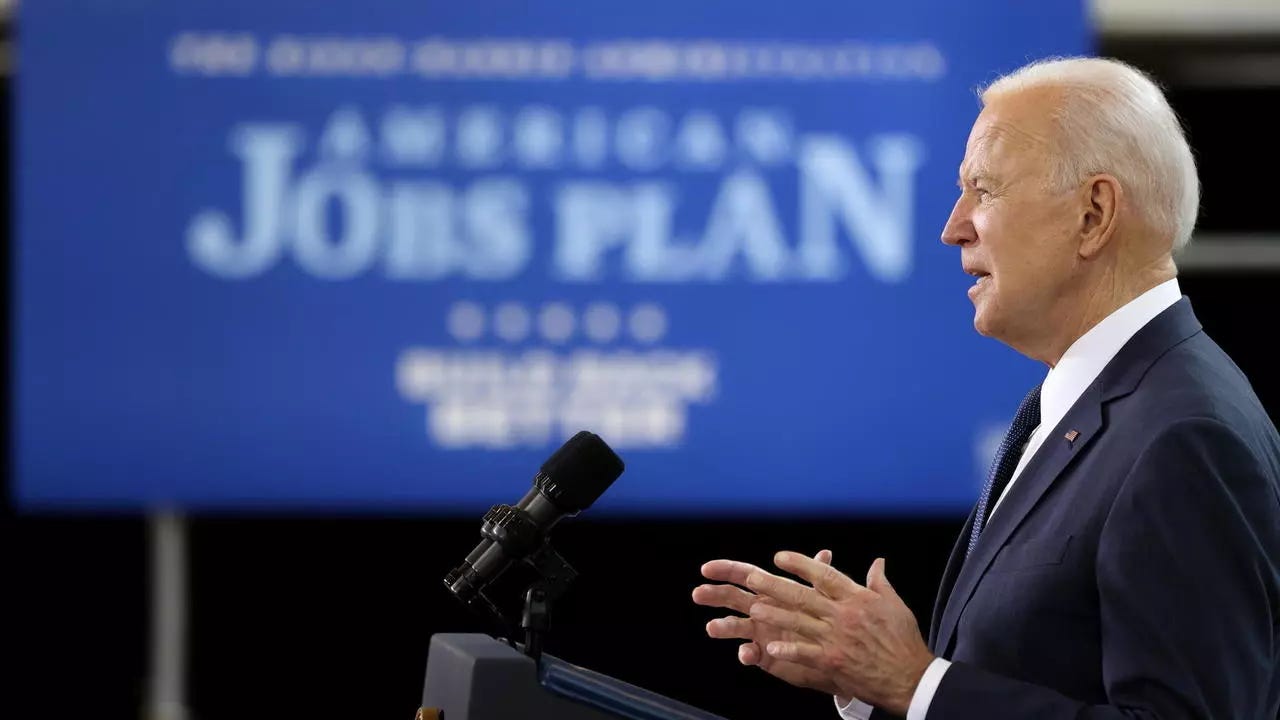

Biden rolled out his $2 trillion Infrastructure Plan last week to great fanfare.

I am beyond excited for Biden’s plan. The US has not invested in itself like this in decades and it shows. Lack of investment has put us behind other countries. The United States currently ranks 13th in the world for quality of our infrastructure and our public domestic investment as a share of the economy has fallen more than 40% since the 1960s.

We just stopped innovating & investing in ourselves.

This plan would get us back on track. It would revamp roads, modernize the transit system, provide universal broadband even hard-to-reach rural areas, invest in clean drinking water (seems like that’d be the norm in the greatest country in the world), shift to green energy, and add jobs to the economy while we’re at it.

But, as much as I’d love to talk about the amazing pieces in this bill that will have a dramatic effect on rural and urban communities alike, I can’t. Instead, I am going to talk about the dreaded “T” word, taxes.

Taxes, Taxes, Taxes

I was talking to a good friend of mine (you know how you are) about the bill and her biggest worry was taxes. The plan sounds great, but is it worth it if taxes go up? It’s a fair question and one that has already gained steam.

The GOP is already jumping at the chance to misrepresent the tax plan to scare their voters away from a bill that will benefit them. It’s no surprise, but it’s something that Democrats need to be aware of to combat the incoming onslaught of disinformation. We have seen the GOP weaponize taxes and their “concern for the American worker” to turn the working and middle classes away from progressive legislation.

The fact is, if the tax plan passes as is, it will pay for the American Jobs Plan in 15 years, and then it will reduce deficits from then on out, while only impacting corporations. Sounds like a good deal to me! (FYI, this is the first of Biden’s Infrastructure announcements, wealth taxes will be included in his 2nd proposal later this summer)

First, let’s address the facts of the plan:

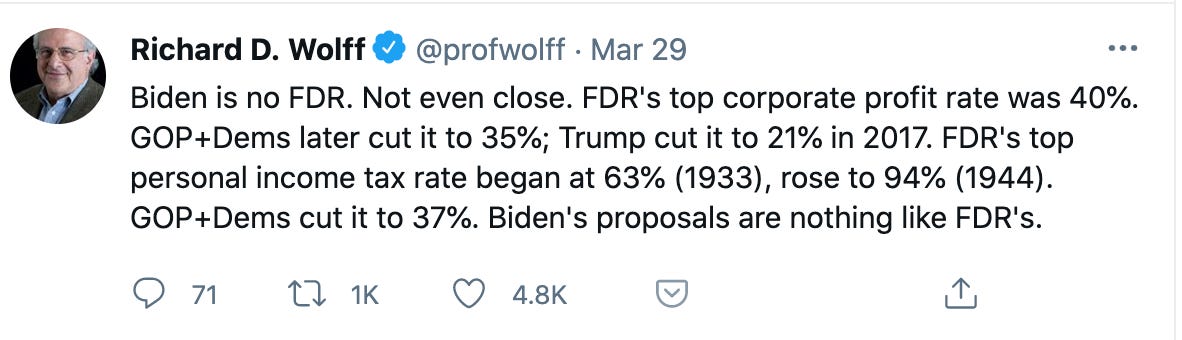

- Raises the corporate tax rate from 21% to 28% (not even hitting the 35% level from 2016, pre-Trump wealth tax cut bill)

- Updates tax policies so corporations can’t dodge their bills (here’s looking at you $0 tax Amazon)

- Rewards investment in the U.S. to limit jobs and profit offshoring

- Calls for a Global Minimum Tax to further limit offshoring

- Eliminate tax preferences for Fossil Fuels (b/c there’s a little climate crisis going on)

Now that you have the facts, how do you talk about it? There are four main arguments to bring up:

- It’s not a tax hike, but a policy reversal

- It’s insanely popular

- It reduces income inequality

- This is an investment in our future & past

It’s Not a Tax Hike; It’s a Policy Reversal

When you hear crazy dollar figures like $2 trillion, you’re probably thinking ‘wow that’s really going to cost the taxpayers.’ But in reality, Biden’s tax proposal is actually not as radical as corporations and the wealthy want to make it out to be.

As Richard Wolff states, raising the corporate tax rate to 28% does not even reverse the 2017 Trump tax bill. Our country had a corporate tax rate of 35% just 4 years ago. We’re not talking crazy here.

Not to mention the clear fact that this DOES NOT impact individuals in any way. Ladies & gentlemen, your tax bills are safe.

It’s Insanely Popular

When voters are presented with a plan to tax the wealthy and corporations, 54% are supportive.

Infrastructure is also incredibly popular and bipartisan. Infrastructure is the rare policy area that receives broad support from all Americans. In Gallup's March 2017 survey, 87% of Republicans, 73% of Independents, and 71% of Democrats agreed with the idea of spending $1 trillion to improve the nation's infrastructure.

There’s a reason that every week of Trump’s presidency was “Infrastructure Week.” Every American sees the decaying infrastructure in our country on a daily basis whether it’s potholes in roads, lack of internet access, or ancient subway trains.

Bottom line, when voters understand the bill, they are overwhelming for it. It’s up to Democrats to explain the bill and not let the GOP convince voters it affects their individual taxes.

It Evens the Score on Income Inequality

Speaking of individual taxes! This is the right tax policy for regular Americans.

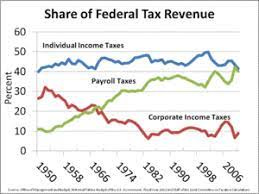

The fact is that corporate taxes have been declining over the decades, while taxes that individuals pay are increasing. A recent study found that 91 Fortune 500 companies paid $0 in federal taxes on U.S. income in 2018. 91! I don’t know about you, but that’s definitely less than what I paid.

And looky here, we have the receipts. Trump’s tax handout to the wealthy (slashing the corporate tax rate to 21%) did not create jobs or improve business investments.

What actually happened was cash flushed corporations spent the money on stock buybacks and increased salaries at the top. It’s another case for why trickle-down economics has failed us.

We are in a moment of dramatic income inequality not seen since the Gilded Age. It’s time the government takes active steps to combat what our past policies have done.

An Investment for the Future & the Past

“Good infrastructure planning is always about looking towards the future.“

Pete Buttigieg summed it up well on Fox News. When it comes to the climate crisis, it’s going to cost no matter what. In the last five years, the U.S. has paid $500 billion in losses and damages from climate-fueled weather disasters. That’s on track to cost $1.9 trillion annually by 2100. Not to mention that 200 people died from the Texas Snow Storms and it was, as I wrote, a completely preventable failure of the Texas government.

This is a no-brainer to me. If we invest now, then not only are we investing in solving the climate crisis, but we’re also investing in our country and its people with new jobs, job retraining programs, and a stronger infrastructure to live and work.

Big things are scary.

Big price tags are scary.

I get that, but what we as a nation get out of this plan is far greater than what we put in.

the roots of change media Newsletter

Join the newsletter to receive the latest updates in your inbox.